For many small businesses, managing physical assets is often an afterthought that is until something breaks, disappears, or depreciates far faster than expected. Whether it’s laptops, tools, office furniture, or leased equipment, assets represent a substantial investment that directly impacts your bottom line. That’s where fixed asset management software for small business becomes a game-changer.

In this article, we’ll break down what fixed asset management is, why it matters for small businesses, and how the right software can help you stay compliant, avoid costly losses, and scale smarter.

What Is Fixed Asset Management?

Fixed asset management refers to tracking and managing a business’s long-term assets. Those items you purchase to operate but don’t intend to sell, like computers, machinery, or vehicles. Unlike inventory, which turns over regularly, fixed assets are retained for extended periods and gradually depreciate over time.

Effective asset management involves:

- Cataloging each asset (location, purchase date, cost, condition)

- Monitoring depreciation and book value

- Scheduling maintenance

- Tracking assignments (who is using what and where)

- Flagging end-of-life items

Doing all of this manually with spreadsheets or worse, not at all can lead to financial inaccuracies, compliance headaches, and wasted spending.

Why Small Businesses Can’t Afford to Skip Asset Tracking

Many small business owners assume asset tracking is a problem for “larger” companies. But the opposite is true. Small businesses often operate with tighter budgets, making each asset more critical to daily operations.

Here’s what’s at stake without proper fixed asset management software:

- Loss and misplacement: Equipment gets loaned out or moved between locations and never returned.

- Compliance issues: Regulatory requirements and tax reporting may demand proof of depreciation and asset logs.

- Insurance complications: Filing claims becomes difficult if you lack documentation of asset value.

- Maintenance neglect: Without reminders, assets may break down prematurely, affecting productivity.

Implementing fixed asset management software ensures you know what you own, where it is, how much it’s worth, and when it needs attention.

Key Features to Look for in Fixed Asset Management Software for Small Business

Choosing the right tool shouldn’t feel overwhelming. Focus on these core features that matter most for small businesses:

- Asset Tagging and Barcode Scanning

- Assign unique identifiers to every asset

- Use QR codes or barcodes to check assets in/out

- Centralized Asset Registry

- Store details like purchase date, vendor, warranty, location, and condition

- Search and filter assets easily

- Depreciation Tracking

- Automatically calculate depreciation using standard methods (Straight Line, Declining Balance, etc.)

- Generate reports for tax season

- User and Location Assignment

- Track who is responsible for each asset and where it resides

- Prevent ghost assets (items that are lost but still on the books)

- Maintenance Reminders

- Schedule servicing and track repair history

- Extend the useful life of your equipment

- Custom Fields

- Tailor your asset profiles with fields specific to your industry

- Mobile Accessibility

- Enable field teams to access or update assets on the go

How AssetCenter Makes It Easy for Small Businesses

At AssetCenter, we’ve built our platform with small business owners in mind. We know you need something that’s powerful, but not overwhelming. Affordable, but not limited. Here’s why businesses choose AssetCenter as their fixed asset management software

- Simple onboarding: Get started in minutes with guided imports and templates.

- Industry flexibility: Whether you’re in construction, IT, healthcare, or retail, we support custom asset categories and fields.

- Built-in compliance: Generate depreciation schedules and audit-ready reports in a few clicks.

- Role-based access: Keep your team focused with permissions tailored to their role.

- Affordable plans: Start free and upgrade only when you need more power—no hidden fees.

Choosing the right fixed asset management software for small business isn’t just about organization. It’s about protecting your investments, avoiding compliance risks, and planning for growth. The earlier you implement it, the easier your life becomes as your company scales.

You don’t need enterprise-level complexity to get enterprise-level control. Try a solution built for small businesses, and give your team the clarity and confidence they need to succeed.

How to Get Started with AssetCenter

AssetCenter is still in development but after we launch you will be able to sign up for a free account on our home page, and sign up for a free trial of the subscription model that meets your needs.

After getting signed up, head over to the My Account page, and Asset Categories. Here is where you will create all of the categories needed in your business.

Below is an example image of what it will look like once you have filled out all of your categories.

Subscription Categories

Once your asset categories are setup you can go setup subscription categories. This is optional but if your business needs to track subscriptions such as software licenses think Adobe Acrobat or Microsoft Office you can setup the categories here.

Start Entering Assets

Now you are setup! You can press the round + button in the top right corner and start entering you assets, subscriptions, people and locations.

Managing Assets

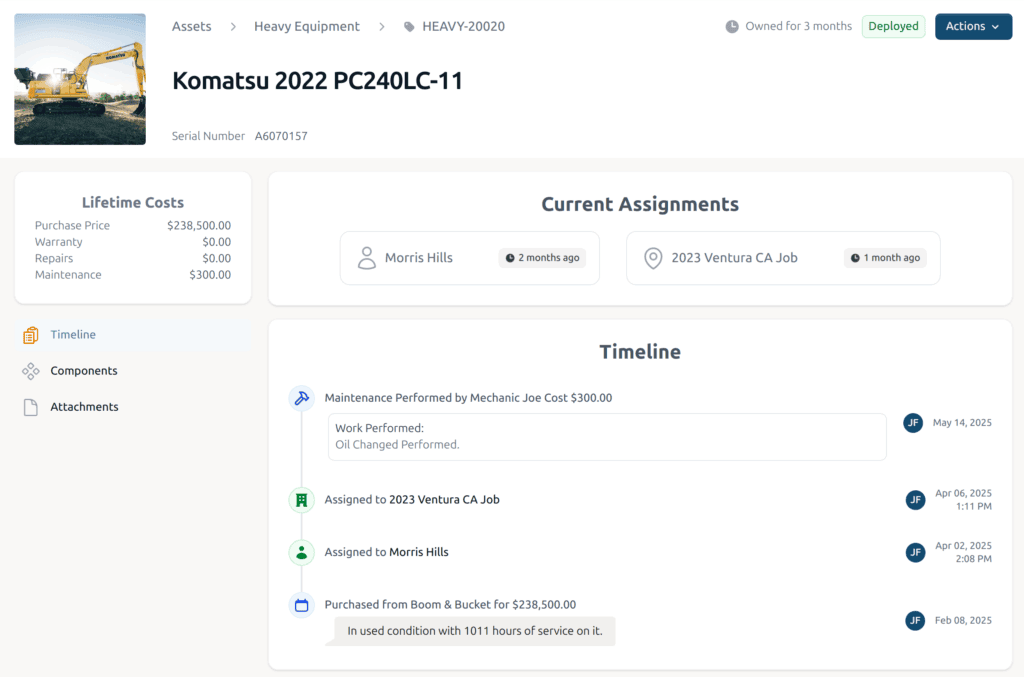

After your assets are entered you can go to an asset from the assets page in the top navigation. Below is an image of a fictional asset. The actions button in the top right is how you manage this asset. From that button you can make comments, track warranties, assign people and locations, record maintenance and its life cycle. Track whether it has been sold, recycled, put in storage, or retired.